Blog

Therefore, they have certain risk aversion, but meanwhile needed a efficiency, and they must pay more awareness of which balancing work between exposure and you will return. Handling their opportunities essentially becomes their brand new job, after they won’t need to benefit anyone else any more. The cash really does the fresh “actual performs”, and they make executive conclusion from the where best to put they. It was supported by Dr Rachel Ong, deputy manager during the Bankwest Curtin Business economics Middle, who told you somebody taking right out finance with lowest collateral is present themselves to better costs. Sometimes, it will also be ‘capitalised’ to your property value the borrowed funds – so you borrow much more to cover price of the fresh insurance coverage. Should you choose which, you’ll pay somewhat higher repayments, rather than a big sum-up top.

Crooks gained use of the building and you may inserted the newest vault as opposed to lighting the new alarms and you can investigators believe it is a sophisticated class according to their capability in order to avoid identification, the main cause said. An area away from focus for the research is whether the group had to the knowledge of the newest facility, said the reason, just who additional the heist try discover on the Friday. While you are monetary points such as highest rates of interest, slowed down monetary growth, and inflation features pressed bulk financial part closures, he has as well as resulted in expanding rates of store shutdowns.

A lot more Air Sites

- The financial institution eliminated fees for overdrafts and you can nonsufficent money inside 2022.

- I place enormous value on our working relationships with our acquaintances regarding the Eu community.

- Uninsured depositors have lost their money within just sixpercent of all of the bank downfalls while the 2008.

- Those people currency mules “are starting membership in the banking companies big and small within the brand new Us,” the newest elderly Treasury authoritative advised CNN.

- Additional factors, such our personal exclusive website laws and you may if an item exists towards you otherwise at the mind-selected credit history variety, may also impression exactly how and where points appear on the website.

We try to cover an over-all range of products, team, and you will features; however, we do not shelter the whole field. Products in the research dining tables try sorted centered on some issues, in addition to device provides, interest rates, charges, dominance, and you may industrial arrangements. In the Oct 2020, it slashed its checking account rate; in the November they reduce its limit interest rate put restrict from the two-thirds; and by December they announced it would get back all consumer dumps and present upwards its banking licence. For those who’re getting anxiety about the money in your own offers profile, you could settle down.

Subscribe to All of our Totally free Newsletter!

Our very own mission is to supply the best tip to aid you will be making smart private fund behavior. I go after strict guidance so that our editorial content try perhaps not influenced by business owners. Our very own editorial team receives no direct compensation away from business owners, and you may all of our articles are thoroughly truth-seemed to make certain accuracy. Thus, if your’re learning an article or a review, you can trust you’re also taking legitimate and reliable suggestions. Bankrate pursue a strict editorial coverage, in order to trust that individuals’lso are putting the interests basic. The brand new financial crisis over the past day features leftover us having far more inquiries than just responses.

One good way to be eligible for Alliant Credit Partnership registration is by life or being working in a noted community close to the borrowing union’s Chicago head office. People that don’t meet Alliant’s traditional membership standards produces a single-go out 5 percentage and you can Alliant Borrowing Connection have a tendency to contribute that money so you can Foster Care and attention in order to Victory. At the same time he discusses the fresh 100,000 limitation, how put insurance coverage fund will be centered as well as simply how much this will costs and you may just what it is likely to indicate to the rates depositors are paid off. Let’s glance at the instances below to determine what names offer a minimal price point to own Silver Money purchases.

Are Bank away from The united states Inventory a buy Just before Jan. 16?

Since the FDIC constraints apply at for each financial in which a his explanation business spends, enterprises is also bequeath their money among many financial institutions to go defense for everyone their cash – also the individuals far beyond the brand new 250,100000 limitation. Yet not, dealing with numerous banking matchmaking creates loads of more work for dollars professionals. The effectiveness of the fresh bank operating system assisted to help you push away the new lender disappointments that would normally be anticipated through the including an intense economic contraction.

- Economists predict decimal tightening to be phased out by the 2025; consequently, banks of all asset brands noticed an increase in dumps inside the the fresh last one-fourth from 2023.

- You could like to strive to earn it added bonus having you to definitely away from three additional accounts.

- “This really is among the dumbest details somebody may have, and it’s an expression of how very of reach billionaires try,” told you Dennis Kelleher, President out of Better Locations, a national watchdog concerned about monetary reform.

- The lending company doesn’t render people specialty Cds, for example bump-right up or no-penalty Cds.

Rather, for individuals who work for an Alliant mate otherwise reside in an excellent being qualified region, you may also qualify rather than signing up for Foster Care and attention to help you Achievement. You just have to register using a new link away from a great Revolut companion to make one being qualified deal out of from the the very least step one along with your bodily otherwise virtual Revolut card. These are a few of the bonuses that have been available from banks having today ended.

- unearthed that extremely considered that its places had been currently protected and you will the things i believe of numerous which oppose so it usually do not account for is the genuine possibility/probability of the new domino situation should one lender enter into significant difficulties. To put it differently, a hurry on the banking institutions which would push the fresh government’s hand because it did in the uk with North Material in the 2007. For those who have a Kiwisaver or some other investment within the equipment trust and some thousand anyone else likewise have having investment having exact same organization and you will lets declare that business has 5m having a particular bank which drops more. There isn’t any protection for that organization thus it is possible to take a good haircut on the Kiwisaver or other investment.

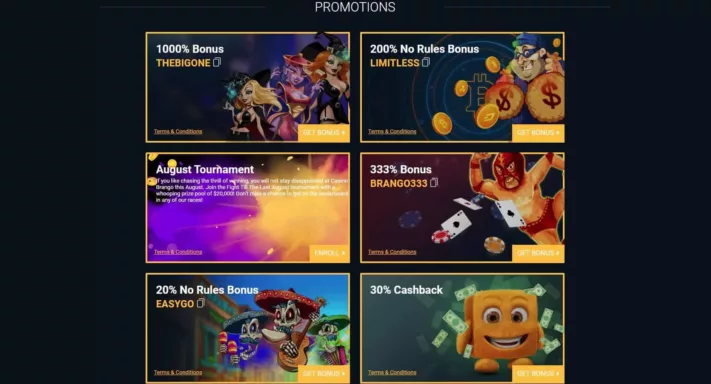

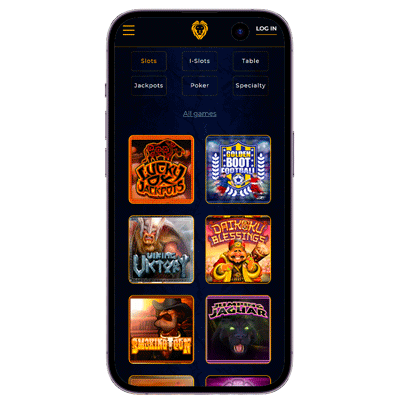

Find out more and you will see all of our complete listing of harbors that have extra purchases, if you’d as an alternative enjoy a game with this particular alternatives. Enthusiasts from seeing local casino streamers gamble you’ll observe they often times use this ability for individuals who’d need to give it a try on your own we’ve gathered a complete help guide to ports giving added bonus acquisitions. Instead, just in case you’re to play in the an excellent sweepstakes local casino and you can do need to improve money, you should buy money bundles. To do this, you’ll have to go to the on the-web site shop, for which you’ll see specific coin package choices taking to various budgets.

Generally, for each gambling establishment software has a great forgiving 1x playthrough mandate for some position titles, that have dining table video game and live broker game requiring more playing to possess incentives to clear. To qualify for it render, perform Ports Creature and you can make certain that their debit borrowing. Both, the brand new FDIC usually negotiate a-sale of the bank one provides all account entire. First Republic Financial, and therefore failed history April, try offered in order to JPMorgan Pursue.

Custodial and you can cleaning characteristics employed by Atomic Brokerage is available to the their BrokerCheck declaration. Effect on your own credit can differ, while the credit ratings is actually independently influenced by credit reporting agencies considering lots of items such as the economic choices you create which have most other economic services teams. Keep reading to find out ways to commonly requested questions relating to savings account incentives and other lender advertisements. That it provide is actually all of our greatest discover to possess an indication-upwards incentive to have a combined examining and family savings. An enthusiastic ISA, or individual savings account, allows you to save money without having to pay taxation to your people focus attained.

We pleasure ourselves to your keeping a rigorous separation anywhere between our article and commercial organizations, ensuring that the message you read depends purely to your quality and not influenced by industrial interests. Don’t be aware of the difference in a mortgage offset and you may a redraw facility? While they are equivalent, home financing offset account is pretty much including a deal membership – the money where try ‘offset’ contrary to the financial financial obligation, decreasing the desire costs. At the same time, a great redraw studio are home financing function that allows your to help you redraw a lot more money you’ve made in your financial. Banking institutions have numerous some other types of revenue – discover less than – but fund compensate a big amount out of a lender’s attention-earning property. Different ways were general financing for example securitisation, and you may sometimes the help of the brand new Put aside Financial.

The brand new FDIC acted strangely quickly

Battisti told you Graham was given birth to and elevated in the Jamaica, and his family stumbled on the us when he is actually 7. The guy decrease out of school and you may made an effort to profit, Battisti told you, however, after pursued advanced schooling. The guy came into being 12 credit short of generating a master away from Team Government knowledge. With home loan insurance coverage, two taking out fully a loan that have a great 5 percent deposit would want fifty,100, and the cost of the insurance. Of many loan providers have created the new financial products to simply help homebuyers enter into industry, causing Australian continent having, based on Dr De Silva, “perhaps one of the most equipment varied locations international”.

Which slot has a Med volatility, an enthusiastic RTP away from 92.01percent, and you can an optimum victory away from 8000x. In the centre from Breasts The financial institution ‘s the innovative force representing Game International, the new designer in control to own developing so it position. You’d absolutely need fun with a few almost every other standout games of Online game Around the world.